- Budget spreadsheet sample install#

- Budget spreadsheet sample full#

- Budget spreadsheet sample Offline#

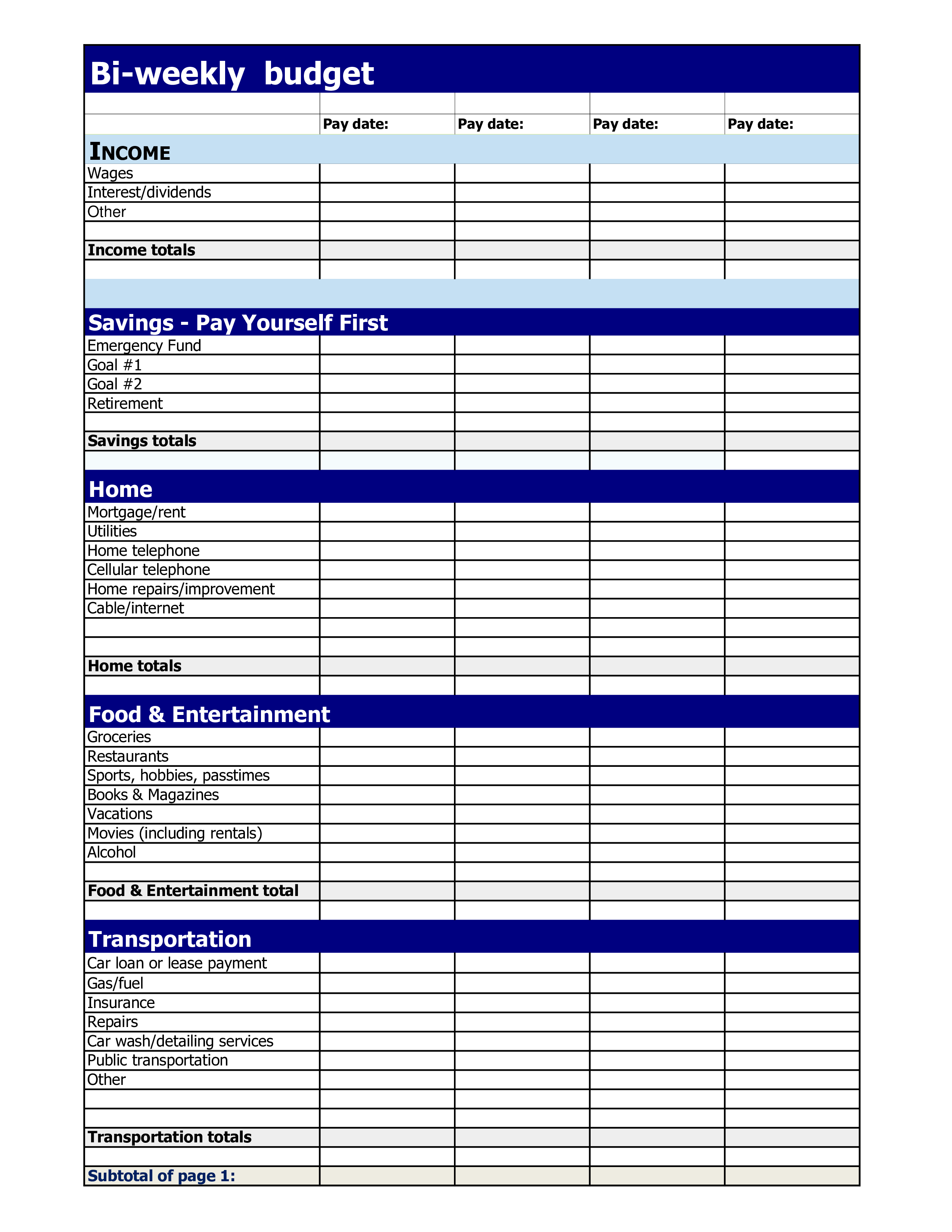

I kept a small memo tablet in my purse & jotted down any- and everything “extra” so I could enter it during the weekly check-up. I was diligent with using this spreadsheet & checked it on a weekly basis. When I used this spreadsheet, I’d plug in all those non-changing items for the whole year (rent, transit expenses, cable, cell phone bill), and for other utilities, I averaged six months worth & added $10 to whatever the average was – since one bill is never the same unless you’re on some type of budget plan – With this guesstimate, I found that I generally had money back in my pocket which I applied to paying off a credit card here’n’there! The other “tools” I’ve used mainly show what I’m spending & when/where I’m spending it (like, when a bill is due, I open my budget spreadsheet, enter the amounts being paid, click AutoSum, and I’m done with it.) Still, I’m finding that I don’t have quite the same “stick-with-it” attitude doing it that way as I do with this one. I personalized it more by adding in extra columns to reflect my bi-weekly pay dates. I’ve used several others since, but I think I’m going back to this one it really is the best. This spreadsheet is very similar to one I used a few years ago. Little reviews and updates can add up to big changes. Step 5: Repeat, Revisit, Review!Ĭheck in with your spending, earning, and debt reduction. By facing the hard stuff and making changes you’ll turn your money around, rather than turning your back on your money. Step 4: Turn it around!įacing the numbers and looking for ways to cut spending, increase income, or changing spending habits can be a messy uncomfortable process. Wherever you spend, however much you owe, whatever you save - Your monthly totals are not your self worth, it’s your starting line.

Family: Childcare, allowance, activities, books, toys.Routine Expenses: Groceries, clothing, personal.Enjoyment: Gifts, holiday, pets, entertainment, restaurants, hobbies.Financial: Bank fees, interest payments, debt repayment, savings accounts.Medical: Prescriptions, dental, health insurance.Utilities: Streaming, internet, phone, electricity, water.Transportation: Car, transit, fuel, maintenance, bicycle.Home Expenses: Rent, mortgage, insurance, maintenance, property taxes.Income: Salary, bonuses, investments, spousal income.Fill in the blanks and account for your cash. Grab your receipts, sort your bills, and check your bank accounts. But getting past the feels can lead to greater money confidence and increased financial independence. Feeling overwhelmed and stressed is normal. Add it up: Tally your monthly expenses.Yes, just message me and we will find the best way to translate the Personal Budget Spreadsheet into your language. No, the spreadsheet is developed in Google Sheets and will only work correctly there.Ĭan we translate the spreadsheet into a different language? Yes, you can print any part of the templateĬan I use the Personal Budget Spreadsheet in Excel? Is the Personal Budget Spreadsheet printable? But keep in mind that it looks best on a desktop or a tablet.

Budget spreadsheet sample install#

Install the Google Sheets app, log in to your Google Account, and open the spreadsheet there. How do I open the Personal Budge Spreadsheet on my phone? They will be able to view/edit it even without a Google account.

Budget spreadsheet sample full#

Yes, the template has full instructions inside.ĭo I need a Google account to use the Personal Budget Sheet?

Budget spreadsheet sample Offline#

Serhii Kovchenko, a spreadsheets expert who automated and designed dashboards and financial templates for hundreds of e-commerce and offline businesses.ĭon’t forget to check the gallery and FAQ below.ĭo you provide instructions for the Personal Budget Spreadsheet? ✅ The tracker can be customized to your brand guidelines.Ībout the author. ✅ Decision-making is considerably optimized with the Personal Budget Spreadsheet. – Can be used for multiple purposes by copying the spreadsheet in a few clicks – Accessible from any device (desktop, laptop, tablet, or mobile)

– Possibility to add any custom income and expense categories Let me help you with the last one and show you the Personal Budget Spreadsheet. Living a modern life is all about tracking: ads, ratings, statistics, and personal finance is not an exception.

0 kommentar(er)

0 kommentar(er)